Haolingxiazai provides the latest software downloads for e-Nota games.

e-Nota

| App Name | e-Nota |

|---|---|

| Genre | Business |

| Size | 10.45 MB |

| Latest Version | 1.41.24 |

| MOD Info | Premium Unlocked |

| Get it On |

|

Do you still write sales notes and count them using a calculator? No need to bother anymore. Use the e-Note application! Make sales notes easy, neat and fast. Suitable for wholesale and retail stores. Try immediately!

Feature:

- List of notes and turnover

- List of memorandum not paid off (receivable)

- List of items and prices

- Knowing which items have sold the most

- Regular and multilevel discounts (example: 5% + 2% + 1000)

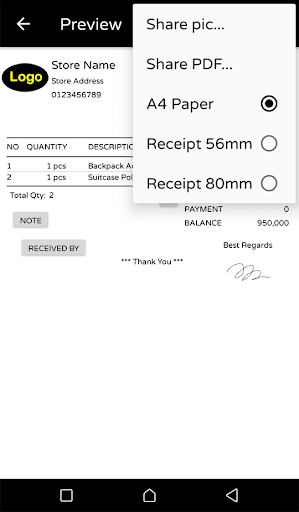

- Print a receipt using the receipt printer (56 mm receipt paper)

- Print notes using a wifi printer (A4 paper)

- Print notes using a dot matrix printer (continuous form)

- Sharing notes to Whatsapp, email and others

- Profit/Loss report

Contact us:

If you have any questions or need help using this application, don't hesitate to contact us via WA +62 812 56789 23 (chat only)

e-Nota is an electronic invoicing system implemented by the Indonesian government to facilitate and streamline the invoicing process for businesses and individuals. It aims to reduce tax evasion, improve tax compliance, and enhance the efficiency of tax administration.

Key Features:

* Electronic Invoices: Businesses are required to issue electronic invoices for all taxable transactions. These invoices must be digitally signed and submitted to the tax authorities through a designated portal.

* QR Code: Each e-Nota contains a unique QR code that allows taxpayers to verify the authenticity of the invoice and its compliance with tax regulations.

* Centralized Platform: All e-Notas are stored in a centralized database, enabling easy access and retrieval for both taxpayers and tax authorities.

* Data Integration: e-Nota is integrated with other tax systems, such as the online tax return filing system (e-Filing), to streamline tax administration and reduce the risk of errors.

* Tax Compliance: e-Nota ensures compliance with tax regulations by verifying the accuracy of invoices and facilitating timely tax payments.

Benefits:

* Reduced Tax Evasion: The electronic nature of e-Nota makes it difficult for businesses to manipulate invoices and evade taxes.

* Improved Tax Compliance: e-Nota simplifies the invoicing process and encourages businesses to comply with tax regulations.

* Enhanced Tax Administration: The centralized database and integration with other tax systems streamline tax administration and reduce the burden on taxpayers.

* Increased Transparency: e-Nota promotes transparency in business transactions and helps prevent fraudulent practices.

* Improved Efficiency: The electronic invoicing process saves time and resources for businesses and reduces the risk of errors.

Implementation:

e-Nota was first implemented in 2019 for large taxpayers. It has since been expanded to cover all businesses registered for Value Added Tax (VAT). Businesses are required to use e-Nota for all taxable transactions above a certain threshold.

Impact:

e-Nota has had a significant impact on the Indonesian tax system:

* Increased Tax Revenue: The implementation of e-Nota has led to an increase in tax revenue, as it has made it more difficult for businesses to evade taxes.

* Improved Tax Compliance: e-Nota has encouraged businesses to comply with tax regulations and has reduced the number of tax audits.

* Simplified Tax Administration: The electronic invoicing process has streamlined tax administration and made it easier for businesses to file their tax returns.

Overall, e-Nota is a key component of the Indonesian government's efforts to modernize the tax system and improve tax compliance. It is a robust and efficient system that provides benefits to both taxpayers and tax authorities.