Sony announced a $1.7 billion stock buyback plan, and its stock price rose by 3.6% immediately!

Common financial operations of large enterprises - stock repurchase has added new cases recently. In its latest financial report, game console giant Sony announced that it would launch a stock repurchase plan worth $1.7 billion. After the news was announced, the company's stock price rose by 3.6%.

Sony disclosed the repo plan through an official press release. Based on the current market value of US$151 billion, the repurchase scale accounts for about 1% of the company's total share capital. The announcement explained the purpose of the repurchase: "The plan aims to improve capital use efficiency and enable Sony to flexibly adjust its holding structure based on factors such as strategic investment opportunities, financial status and stock price fluctuations."

Based on the company's financial performance, the PlayStation maker's operating income in the last three months of the fiscal year was 203.6 billion yen (US$1.39 billion), a year-on-year decrease of 11%.

Sony also disclosed information about the spin-off of some financial businesses. Through the dividend, the company intends to pay more than 80% of the company's common shares to shareholders of Sony Group. Sony said the financial business will be listed this year and will be classified as interrupted in the company's current quarterly accounting statements.

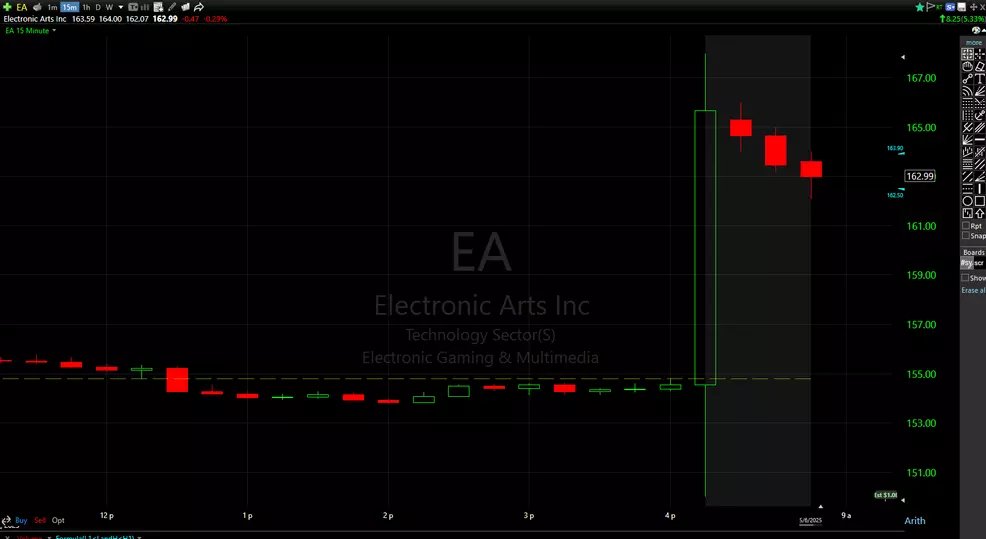

Stock repurchase has become a common financial means for technology giants. Earlier this month, EA disclosed that it spent $2.5 billion to repurchase shares in fiscal 2025, and Apple even carried out repurchases almost every quarter.