The leeks cut from the takeaway war are actually merchants? The more you sell, the more you lose!

The subsidy war on food delivery platforms has continued to heat up recently, and even led to the strange phenomenon of "reverse order acceptance" - after merchants participated in full discount discount, the average order income was lower than the cost, and they fell into a vicious cycle of "higher sales and heavier losses".

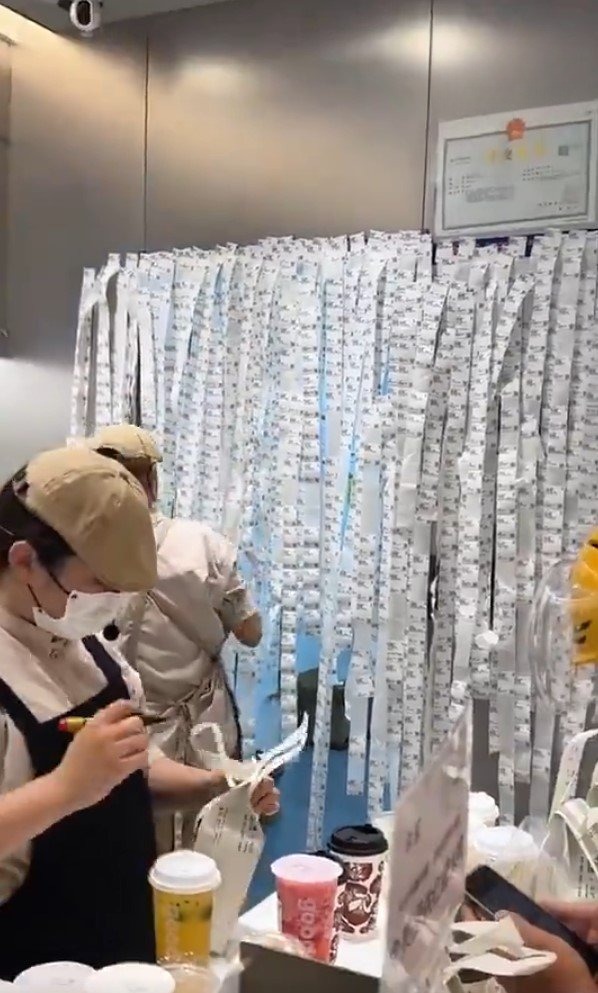

Operator of a milk tea shop in Hangzhou revealed that the daily order volume on weekends exceeded 1,600 cups, but after deducting the platform commission, delivery fees, raw material costs and overtime fees, the net profit was only 400 yuan. "Sending red envelopes to employees is like doing nothing." He smiled bitterly.

In more extreme cases, after some drinks participated in the "10 discount for every 12" activity, the merchant's actual payment was only 3 yuan, and the cost per order was paid. Some practitioners revealed that the platform's subsidies claimed by the platform are actually borne by 60%-70% by merchants, resulting in a "false prosperity" - order volume soared, but profits declined in an avalanche.

Data shows that on July 12, Taobao flash purchases exceeded 80 million in a single-day order, and Meituan instant retail order volume reached 150 million. Behind the platform data has repeatedly hit new highs, there is a collective dilemma of a large number of merchants "exploding orders but not making money". This subsidy game is evolving into a dual variation of platform data carnival and merchant survival crisis.