Xiaomi Automobile has an average loss of 45,000 yuan per unit. Is the road to profitability of smart cars?

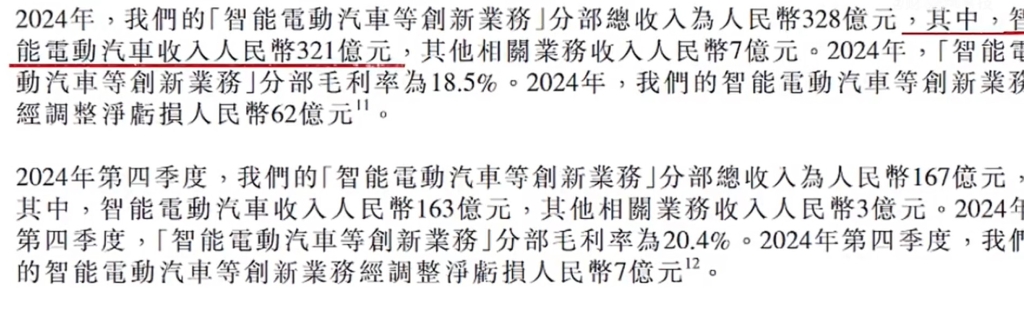

Recently, Xiaomi Group released its fourth quarter and full-year financial report for 2024, and the financial data of the smart electric vehicle business in the financial report has attracted widespread attention. According to the financial report, Xiaomi Auto delivered a total of 136,854 Xiaomi SU7 series cars in 2024, with revenue of 32.1 billion yuan for smart electric vehicles. However, the adjusted net loss of the business reached RMB 6.2 billion. This means that Xiaomi Auto loses about 45,000 yuan on average for every car sold.

Xiaomi Group has been attracting much attention from the industry since entering the field of smart cars. Xiaomi Auto's first model, SU7, started delivery on April 3 last year, and achieved delivery volume of more than 130,000 units in just over 8 months, ranking first among all new models of new forces. However, despite considerable delivery volumes, Xiaomi Auto still faces huge challenges in terms of profitability.

Financial report data shows that the gross profit margin of innovative business branches such as Xiaomi smart electric vehicles in 2024 was 18.5%, far lower than the industry average. Lu Weibing, partner and president of Xiaomi Group, said at the performance call that Xiaomi Auto is still in its early stages and its scale is not large enough. Due to the initial reinvestment of self-built factories and self-developed core technologies, the cost will be shared, so there will be losses in the early stage. This is a common law in the entire electric vehicle industry. In the future, as the delivery volume increases, losses will gradually narrow and the scale effect will become more prominent.

Although facing losses, Xiaomi Auto did not stop moving forward. The company is continuously increasing R&D investment to enhance product competitiveness. At the same time, Xiaomi Auto is also actively expanding its market and attracting consumers by launching more models and preferential policies. For example, Xiaomi's upcoming new model YU7 is highly anticipated and is expected to be launched from June to July this year, with a price of between 225,900 yuan and 235,900 yuan.

In addition, Xiaomi Auto is actively exploring new business models and profit channels. For example, companies are considering increasing revenue streams by providing value-added services such as smart driving services and in-vehicle entertainment systems. At the same time, Xiaomi Auto is also strengthening cooperation with upstream and downstream companies in the industrial chain, improving profitability by integrating resources and reducing costs.

Industry analysts pointed out that Xiaomi Auto’s challenges and opportunities coexist in the smart car track. On the one hand, with the intensification of market competition and the continuous changes in consumer demand, Xiaomi Auto needs to continuously improve product quality and service level to meet market demand; on the other hand, with the continuous advancement of technology and the highlighting of scale effects, Xiaomi Auto is expected to achieve profitability and occupy a larger market share.